Random Find today in Orange County:

The One Dollar Bookstore!

There are literally thousands of books in this completely disorganized, but totally fun bookstore. And every single book is one dollar. There seem to be a lot of textbooks for the local junior colleges too.

For some reason, the One Dollar Bookstore hosts yoga classes on Tuesday and Thursday nights at seven. You can pay $11 or donate an hour of your time to alphabetizing books.

As I've said before, one of my biggest weaknesses is the book section at Goodwill. This place is even cheaper!

A blog about spending wisely in your twenties, with advice on everything from cooking to saving money on gas; how to teach yourself to save money instead of spending it, traveling without breaking the bank, and much more.

Saturday, April 5, 2008

For the Locals: Books for $1

Friday, April 4, 2008

Get a Little Self Control: Track Your Spending

Perhaps not too shockingly, most young adults do not keep careful track of their spending. They've got no idea where their money going and as long as the rent and bills are paid, it doesn't seem to matter. My favorite excuse for this behavior was something along the lines of "I worked for it, I can do what I want with it!" Which, while entirely valid, isn't going to make anyone financially stable. Just barely solvent maybe, but not stable. A person could be $500 or more into overdraft (like I was three years ago), but as long as someone will give them cash for a paycheck it becomes easy to ignore a nasty, embarassing financial situation.

Tracking your finances can seem overwhelming, and if you're already in a nasty position just beginning to track them forces your head out of the sand. Denial is often more fun than having to look around at the hole you're in. Even if you're not in a financial pit, tracking your spending meticulously is enlightening. You're probably bleeding out money on unnecessary purchases without even realizing it.

Keeping an eye on your spending doesn't have to be an awful chore. It's not even hard, once you're in the habit. Here's my advice for making it a habit:

(1) Have at least one set time a day to record your daily spending. Pretty much everyone I know sits down at the computer for a while once they're home from work. Taking 5 minutes away from facebook or myspace shouldn't be too hard.

(2) Don't rely on your online banking transaction record to be accurate. Too often we just glance at our balance online and make spending decisions based on that. But the available balance may not be the actual balance, or transactions might take a few days to post, both of which can send you into Overdraft Land. (But you've got overdraft protection now, right?)

(3) If keeping a spreadsheet or a Quicken file together seems to boring or complicated, try keeping a journal a la Bridget Jones. Bridget would write about her day and at the bottom of her entries she'd keep of record of various personal statistics; cigarettes smoked, pounds gained/lost, and so on. If you're in the habit of blogging or bulletining on MySpace or whathaveyou, this shouldn't be too hard.

(4) If you can't keep a mental record of what you've spent, get a receipt for everything. Then, at the end of the day (or whenever you sit down to record your spending), pull out the receipts and consolidate the information.

Until this year, I never kept meticulous track of my spending. I began to obsessively track my spending on February 7, 2008. (Yes, it was that recently.) In just over a month, keeping careful records helped me to push my net worth (small though it may be) into the black and helped me to give myself about a $100 cushion in my checking account.

I'm not rich by any means, but I know exactly where my money is going. Recording my spending has put me in control of it, and I'm finally in a position to start paying off my random debts.

Thursday, April 3, 2008

5 Money Saving Alternatives to Stuff We Do All the Time

There are a few behaviors that seem almost universal to twentysomethings. With few exceptions, we love to go out with our friends. We end up eating fast food because at some point during the day (or night), we skipped a meal. We go to the movies and drop $10 or more because we didn't plan ahead and we're sick of all the movies we own. I'm sure there are more, but I believe the five activities that follow are where we lose the most of our money- either we're having so much fun that we're not paying attention to how much we're spending or we're in denial about how much we've got available to spend. Either way, here are a few ideas to help you hang onto some of that "discretionary" income.

(1) A Night Out at the Bar: Hanging out at the bar is fun - and lord knows I miss it at times, I used to go at least weekly – but you can have perhaps just as much (and arguably more meaningful) fun at home. Buy a 12 pack and invite some friends over. Assign Bringing More Beer to some, and Bringing Snacks to others. Instead of running up a $10 -$20 tab and then waiting to sober up, go ahead and invite a few friends over to get tossed on a Saturday night. You’ll all save money!

(2) Starbucks/Smoothies/Soda: Whatever your overpriced beverage of choice, you can replace it and save money by doing it yourself. Make coffee at home. For the cost of a Frap and a muffin, you can get a big can o’ coffee. It’ll last you at least a month. Get a blender and make smoothies at home. Instead of soda, get addicted to another beverage (sweet tea and apple juice did it for me.) Instead of meeting up at Starbucks, invite a friend over for sammiches and tea. Or put together a small picnic and meet at the park.

(3) Dinners Out: Host a Pot-Luck. Invite everyone to bring a dish, or ingredients for a dish. Scramble up enough tables and chairs, and have a sit down meal at home with friends, instead of spending $16 a plate (plus drinks!) for a meal that either won’t fill you up or will leave rotting forgotten leftovers in your fridge.

(4) Fast Food: Don’t. Pack a lunch or dinner. I’ve gotten into the habit of taking a water bottle (or a sipper of tea or juice) and a bag of cookies or another snacky type food out with me on errands. When those errand running snack cravings attack, I sooth them with a cookie (homemade, of course).

(5) Movie Tickets: Oftentimes the “What do You Wanna Do? – I Dunno Whadda YOU Wanna Do?” conundrum ends in catching the latest flick. These days a movie ticket is at least $10 (around here anyway.) Ouch. Even seeing a matinee hurts. Instead, wait for movies to hit the dollar theater and go there. Or better yet, get a Netflix account. Or host a movie night at the house of your friend with the largest TV.

Wednesday, April 2, 2008

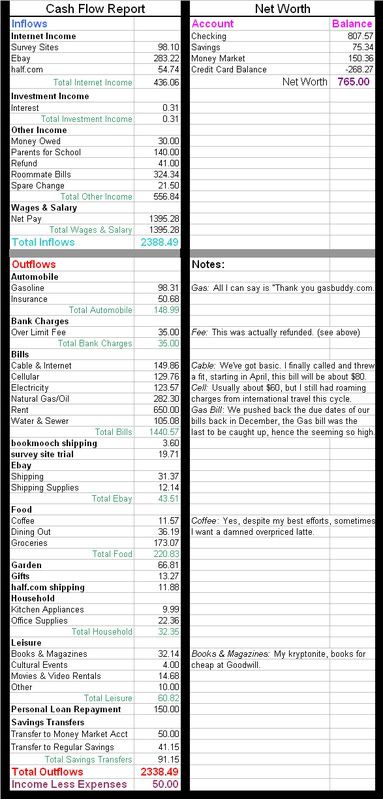

Income & Spending for March

As promised, here's my cashflow and net worth report for March. I haven't quite settled yet on just how exactly I'll be presenting this, but for now this format will do. I've got quite a few areas to try to avoid spending next month, the greatest of which is groceries. I could potentially Not Spend upwards of $400 next month if I am disciplined.

I don't believe I'll feel deprived at all by curbing my spending so radically. As I said in my post announcing my plan to use my stores of food instead of shopping, I don't expect to bring in nearly as much income in April as I did in March. So in order to offset that, I'll be spending quite a bit less. I've got plenty of books to read, a Netflix account (Boyfriend and I have every episode of Star Trek ever queued up), basic cable, a high speed internet connection, board games, a bunch of unfinished craft/mending projects begging for my time, the list goes on.

I do plan on planting a dwarf citrus (most likely lemon) tree in a planter with some flowers and herbs around the middle of the month, and I plan to spend $100 or less on that project. Other than that, I plan to incur no major expenses except utility bills, rent, and gas for my car.

Tuesday, April 1, 2008

Lost in the Supermarket

While I tend to shop for groceries at the stores with the lowest prices and to prepare my food at home rather than eating out, I've yet to develop a system for grocery shopping. Some months I spend as little as $25, and others I'll spend upwards of $200. Over the past few months, I've managed to put away a hibernation-worthy stash of ingredients, all of which could be used to feed me over the next month. I've got lentils, chick peas, pasta, a billion cans of tomato in various forms, vegetable boullion cubes, carrots galore, a full spice rack, pretty much everything I need for baking, even a box of soy milk and a box of chai concentrate, plus much more.

While I tend to shop for groceries at the stores with the lowest prices and to prepare my food at home rather than eating out, I've yet to develop a system for grocery shopping. Some months I spend as little as $25, and others I'll spend upwards of $200. Over the past few months, I've managed to put away a hibernation-worthy stash of ingredients, all of which could be used to feed me over the next month. I've got lentils, chick peas, pasta, a billion cans of tomato in various forms, vegetable boullion cubes, carrots galore, a full spice rack, pretty much everything I need for baking, even a box of soy milk and a box of chai concentrate, plus much more.

After reconciling my accounts for the month (I LOVE the last day of the month, but more on that tomorrow), I began to despair at just how much I've spent on groceries in the last month. ($203.64, including dinners out). I was able to bring in a lot of extra income last month, but this month between going back to school and choosing to see my significant other rather than working until 2am three or four nights a week, my income is going to be significantly lower. So rather than bust my ass trying to sell EVERYTHING I own on ebay I'm going to try to hang onto as much of my money as possible. More on exactly how I'm going to do that tomorrow, but the main avenue for savings in April is going to be Not Spending on Groceries.

Luckily, I get one small meal a day at my job when I'm working. It's not the healthiest meal (I work at a much-beloved by the natives California drive-thru burger place), but it is pretty much the only meat I ever eat. I'm a quasi vegetarian. My boyfriend is vegetarian, by the time I'm home from work I do not want to look at meat no matter what it is, and eating semi-vegetarian is cheaper for me.

On Thursday I'm heading to the Farmer's Market to pick up some fresh veggies, but other than that I'll be eating from my current food supply. I'll be keeping track of my meals and the ingredients I'm using (and of course I'll post my recipes, or link to the equivalent online if I've used one from a book). At the end of the month I'll take stock of how well I ate- hopefully it will give me a framework to develop a streamlined mealplan upon.

Not to mention, I'll know what to keep in stock at home in case zombies ever attack and I can't leave the house for several months.

Monday, March 31, 2008

Get Rid of Your Crap

The upside to having spent a lot of money on (mostly) crap when I was younger is that there are tons of folks who want to buy my crap. Vintage dresses, handbags I don't carry anymore, Dungeons & Dragons miniatures (ok, so they're still not crap by my definition, but I haven't got the time to play anymore, and many of them are worth 30 times more than I paid for them), CDs, books, the list goes on.

The upside to having spent a lot of money on (mostly) crap when I was younger is that there are tons of folks who want to buy my crap. Vintage dresses, handbags I don't carry anymore, Dungeons & Dragons miniatures (ok, so they're still not crap by my definition, but I haven't got the time to play anymore, and many of them are worth 30 times more than I paid for them), CDs, books, the list goes on.

During the last month I began the process of selling off my crap. I've made about $250 after shipping supplies and eBay fees. And I've still got plenty more closet to clean out. I have two huge bins of CDs, DVDs, and computer games - items that I definitely won't make my money back on for the most part- but considering that they've been parked in the garage since September, and in a box under the stairs in the apartment before I moved here, I'd rather have the cash.

I've also got a veritable crap-ton of clothes that I don't wear. Some of them are best off going to Goodwill for the tax write-off, but many of them are cute and sell-able. I've noticed that many of the clothing buy/sell/trade stores around here are complete snots when it comes to what they'll buy, and more than once I've seen my items on their racks for sale, items that they refused to purchase from me but offered to "donate." So eBay it is. Selling clothing on eBay is harder than selling media or collectibles. Vintage dresses and the like are easiest, but if you've got a cute model and a semi decent photographer, your listings will stand out. If you sign up for an eBay storefront and leave the listings up indefinitely, you'll also have better luck selling clothes you don't wear anymore- not to mention you'll make double or more what you might get at a buyback store.

Perhaps the easiest items to begin selling off are books. Half.com allows you to leave listings up indefinitely, though anything that sells for $.99 or less is better for trading on bookmooch. We tend to hoard books, even ones we have no intention of ever reading again, and so they sit unused on shelves when they could easily be sold or traded instead. Books are some of the simplest items to package and ship, not to mention cheapest with the USPS' Media Mail option.

Granted, you're not going to make millions of dollars selling all your junk, but you might be able to give yourself a cushion in your checking account that you didn't have before, or sock away $100 towards a trip to Europe (or whathaveyou), or pay back some debt with money you didn't have to kick your butt at work for.