How to Spend a Few Days in:

San Francisco

...and come home with a positive bank balance.

Note: Most of these guides will be somewhat California-centric until I can get some guest posters in this category.

Getting There

(1) By Train: If you're leaving from the LA/OC area, as most of my current readers are likely to be, I cannot recommend going by train enough. Taking the Amtrak Coast Starlight from Union Station in LA to Jack London Square in Oakland costs between $120 - $140 per person, round trip, less if you're a student or if you have AAA. The seats are HUGE, there's an insane amount of legroom, and the trip is beautiful. You see parts of California you might never see otherwise. Be careful when you book, many LA-SF Amtrak routes require time on a bus. These fares are cheaper, but they defeat the purpose of taking the train in the first place. Taking the Starlight from LA to Oakland and then BARTing into the city is a much more pleasant trip. Downside: It takes about 10 hours, not including any delays that might crop up, and the food onboard is expensive and not that great. I recommend packing a light lunch, snacks, and dinner.

(2) By Bus: Greyhound has some great fares, generally about $80 for a refundable ticket and $45 for a non refundable ticket from LA to San Francisco. There's also the California Shuttle Bus with fares between $45 and $60. The biggest disadvantage to bus travel is the lack of freedom to move around. The biggest advantage is the fare, of course.

(3) By car: With gas prices trending upward the way they are, I do NOT recommend this option unless you've got a full car and you're all splitting the gas. Even then, parking is expensive in San Francisco ($25 a night, at least). So unless you're splitting those costs between three or more people, ouch. If you're going in a group, my best advice is to get a one way rental for the trip up, and another for the trip home. And if you must take your own car, park in a remote lot outside of the city and take the BART (subway) in.

(4) By air: If you're flying from anywhere on the western seaboard and you can find roundtrip tickets for significantly less than taking the train, then you should definitely fly. If you're flying from farther away, the usual tips for cheap airfare apply, shop around, buy in advance and fly on off-peak days, like Mondays or Tuesdays.

Where to Stay

(1) Hostels: Thanks to bad movies and a general misconception of a what a hostel is, most people avoid them. Perhaps others don't realize that hostels exist outside of Europe. Whatever the reason, I find that many people don't even think to book their lodging at a hostel. Beds in a dorm room can run anywhere from $12-20ish a night, and private rooms anywhere from $24-$40 a night, still a significant savings over nearly any hotel that isn't completely seedy. I've stayed at the Amsterdam on Taylor Street and the nearby Adelaide. I stayed in a private room at the Amsterdam for about a week, with its own bathroom, a dresser/wardrobe, a fridge and a microwave. No TV, but I seldom even watch TV at home- and why on earth anyone would spend so much money travelling just to watch TV in their room is beyond me. The Amsterdam boasts free wireless and free all-you-can-eat belgian waffles in the morning (I advise you get there early.) I've stayed in dorm rooms at the Adelaide, which are generally segregated by gender, and include a sink/mirror in room (the bathroom w/shower is seperate), and a locker (bring your own lock). The Adelaide also boasts free internet, but the breakfast isn't as good. If you're traveling as a couple, a private room is the best choice. If you're travelling alone or in a group, I'd advise a dorm room.

(2) Hotels: As with travelling by car, I really only recommend this option if you're in a group and splitting the cost. Even then, you're most likely going to be paying double or triple what you'd be paying at a hostel. Unless you know someone in the industry with a significant discount, you should opt for one of the hostels.

(3) With Friends: Really the best option if you're alone or in a group and it's available to you. If you're travelling as a couple...well, crashing on your buddy's couch for more than a night or two might get old. If your gracious host is still working while you are on vacation/visiting, that might also be a negative. A combo of a buddy's house + a few nights at a hostel is also a great idea.

(4) Couchsurfing: I've never couchsurfed myself, but I hear it's great fun if you're up for it.

Getting Around

(1) Public Transit: San Francisco has one of the best public transit systems in the country. Please, I beg of you, use it. If you're only going for a day or two opt for a day pass. If you're staying more than a few days, go ahead and opt for the 3 or 7 day Muni Pass. MUNI is the bus/light rail system that covers pretty much the entire city. BART covers a few major stations in San Francisco, and a significant chunk of the East Bay.

(2) Your Feet: San Francisco has a land area of less than 50 square miles. You can walk most places. Unless the hill is too steep or your feet are too tired. Then you can hop on MUNI.

(3) Taxis: Please don't take cabs unless you're somehow nowhere near a bus stop and it's really late at night and you're to tired/drunk to stumble back to your lodging.

What to See

(1) Museums: If you go during the first week of the month, you can get into some of the best museums for free, not to mention the San Francisco Zoo. Here's a guide to their usual admission prices:

Free on the First Tuesday of the Month

SF Museum of Modern Art (MOMA): $12.50 Adult / $7 Student

Asian Art Museum: $12 Adult / $7 Student

Legion of Honor (Fine Arts Museum): $10 Adult

de Young (Fine Arts Museum in GG Park): $10 Adult / $6 Student + any special exhibition fees

Yerba Buena Center for the Arts: $7 Adult / $5 Student

Cartoon Art Museum: $6 Adult / $4 Student

Museum of Craft & Folk Art: $5 Adult

Conservatory of Flowers (in GG Park): $5 Adult / $3 Student

California Historical Society: $3 Adult / $1 Student

Free on the First Wednesday of the Month

California Academy of Sciences: closed until September 2008

Exploratorium: $14 Adult / $11 Student

San Francisco Zoo: $11 Adults

I've only profiled the first week of the month because that's when most of the "big ones" are free. Don't go to a museum just because it's free, check out their websites, figure out which ones you'd most like to visit, then make your decisions based on normal admission fees. Many museums are cheap if you've got a student ID, so there's a little more wiggle room there.

(2) Landmarks: The Golden Gate Bridge, Fisherman's Wharf, Lombard Street, The Full House House (Alamo Square), the Palace of Fine Arts, Coit Tower, the list goes on and on, and most of them are free. Some San Francisco landmarks can be visited with little fear of someone waving an overpriced t-shirt in your face. Some (read: Fisherman's Wharf) cannot. Here's the thing about Fisherman's Wharf, it can be a lot of fun, and there's a lot of to see, but most of it is insanely overpriced and not really very interesting. Go for the Sea Lions though, and stand across the street and watch the Bushman scare the crap out of the other tourists. Just please don't buy any stupid overpriced Alcatraz souvenirs. If you realllly want an "Alcatraz Escapee" shirt that you'll never wear, check a local Goodwill.

Speaking of Alcatraz, don't even thinking about trying to get out to that island unless you've bought tickets in advance. If you try to buy them at the Pier, you're going to get reamed

Food & Dining

(1) Bring Snacks. Don't wait until you're hungry to scavenge for food. Hit up the nearest Safeway and stock up on some water bottles, juice boxes, granola bars, fruit, or other healthy, filling snacks. These aren't meant to replace meals, just to get you through the urge to buy overpriced goodies to snack on. That way, you'll have more money to spend on dinner.

(2) Plan Meals Ahead. Have at least a vague idea of where you'd like to have your meals. Do a little research (SF Gate Food & Dining, Citysearch) before you go. Plan to have dinner near whatever attraction you'll be visiting in the later half of the day.

(3) Eat Within Your Means. Don't blow your money on eating at an upscale restaurant every night. You are on vacation, so one really nice meal isn't anything to beat yourself up over, but there are hundreds of moderately priced restaurants with amazing cuisine all over the city. There's really no excuse to be paying more than $15 a person, TOPS. Food is the easiest category to blow all of your money on, so really watch this.

I am aware that most of these tips can be applied for traveling almost anywhere. I reserve the right to come back and edit this post to make it more and more applicable to SF only. This guide is far from exhaustive, but I wanted to present the idea that it is entirely possible to spend a week's vacation in a major city for less than $1000 for two people if you plan even just a little bit ahead. I'll be adapting this into an exhaustive non-destination specific guide in a few weeks.

A blog about spending wisely in your twenties, with advice on everything from cooking to saving money on gas; how to teach yourself to save money instead of spending it, traveling without breaking the bank, and much more.

Friday, March 21, 2008

San Francisco on the Cheap

Vacation, All I Ever Wanted

Most of us can't afford too many big excursions out of the country, though I'd argue that traveling to a foreign country once every year or so is NOT an extravagant waste, in fact it is something you should save and plan for, if possible- but that's another post. When you are young and mostly broke (and by broke I mean living paycheck to paycheck, not saving much), simply Not Going to Work for a day or two can feel like a huge vacation.

Everyone travels to escape everyday life (and for a myriad of other reasons too, but escapism is the big one), and the traveling mentality often lends itself to irresponsible spending, especially when you're younger. Many of us don't even spend a full week planning before we skip town, and we end up draining our bank accounts and charging up our credit cards.

Then we come home to a tiny, tiny paycheck. Whoops.

And now, in a semi-regular series I'll be posting destination-specific thrifty travel guides so you can get out of town and have a little fun without coming home to a pile of overdraft notices. I'll be employing the help of friends and other bloggers so the series can be more diverse.

Later tonight, I'll begin with an extensive post on how to get the most out of San Francisco including; how to get into nearly every major SF museum for free, how to stay near Union Square for a week for less than $500 for two, how to get the Fisherman's Wharf experience without paying for it, and more!

Thursday, March 20, 2008

The British Invasion

About six months back, British ubermarket Tesco (think Target or Wal Mart on steroids) began a venture into the American market with a chain of small grocery stores called Fresh & Easy. They began by rolling out about one hundred stores in the Southwestern US. I read a review of the flagship Glendale store on LAist in November-ish, but I didn't actually shop at a Fresh & Easy until February.

I was up in Boyfriend's neck of the woods (in LA) and we drove by a Fresh & Easy just as we were both complaining about being hungry. It was almost ten on a Sunday night and Fresh & Easy seemed like one of the few places that might feed us both- he's a vegetarian and I'm just an indecisive eater. Not picky. Indecisive.

Perhaps the most striking feature of a Fresh & Easy is the lack of cashiers. Or the plethora of robot cashiers, depending on how you look at it. What hit us next was how very like the grocery section of a Tesco it looked. My Mother, Stepdad, and Half-Brother live almost across the street from a Tesco in Britain. Boyfriend and I visited them in January, and when your mother's got a 6 month old to care for and you're flat broke in a foreign country visiting your folks...well, let's just say we spent a lot of time at the Tesco.

Boyfriend got excited when he realized there was vegetarian-friendly food that might actually fill him up and taste good. I started to get really excited when I looked at the prices. Oh my sweet lord are they low! I didn't actually go to Fresh & Easy for proper groceries until this last Sunday, and I don't know that I've ever before walked out of a grocery store feeling like I robbed them.

I bought:

A huge tub of Sour Cream

12 bagels

A jar of ground cinnamon

A package of tri-color noodles

A can of chipotle peppers in adobo sauce

A jar of sauerkraut

A huge can of coffee

and A bottle of pure vanilla extract (not imitation crap)

For $15.23(!!) after a $5 off coupon (most stores are giving away $5 coupons like candy right now. The new chain is apparently under-performing so far this year, which is a shame.)

I'm a huge proponent of shopping at cheaper grocery stores. In Orange County, Stater Bros, Food 4 Less, and now Fresh & Easy are generally the best bets. I've got an Albertson's conveniently around the corner from my house, but I avoid it because other stores are almost always cheaper. When I'm in a hurry and end up buying ingredients at Albertson's (or worse, Ralph's!), I always wince a little when I pull out my debit card.

Fresh & Easy Markets are popping up everywhere, and I can't recommend them enough. If you're in the Southwest, and you've got groceries to buy this week, try Fresh & Easy and let me know what you think of them!

And no, they're not paying me for this. :-)

(almost) Free Books!

Bookmooch.com might be one of the greatest websites, ever. Bookmooch is a giant, global bookswap in the spirit of peer-to-peer filesharing but with a physical commodity instead of (totally legal!) mp3s.

To get a book (or books) you spend points. You earn points by listing books, sending books, and leaving feedback for other members. It's a great way to get rid of books you don't want that aren't worth selling, and an awesome way to get books you do want. All you ever pay is shipping for the books you give away. You don't pay shipping for the books you mooch.

Buying books new makes me cringe. Between a couple of well stocked local Goodwills, amazon, ebay, and bookmooch, I never need to. Let someone else pay full retail!

Wednesday, March 19, 2008

Use Your Kitchen!

And I don't mean to make instant ramen or a Hot Pocket, either. I would argue that one of the biggest leaks in our cash supply is food, and not just because we like to eat out with our friends. Most of us can't really cook anything that requires more than boiling water and a flavor packet. One of the great failings of school systems today is that "Home Ec" and "Bachelor Living," (as the male version was called in North Carolina in the 70s) are no longer required courses. The vast majority of twentysomethings have no idea how to make pancakes without a mix, or the basic construction of a casserole. Many of us were raised by parents who couldn't cook either, and it all adds up to a great, big waste.

I was lucky enough to be raised by a mother who wanted to be a chef (who eventually became one) and a stepdad who was part of a vegetarian collective in college, before he married into fatherhood. So, my parents can cook. My sister and I have a more advanced knowledge of how to move around in a kitchen than most people our age. So, in a semi-weekly series, I'll be writing a post about how to use your kitchen. Everything from basic tools, ingredients to have on hand, recipes for your own convenience foods, even making your own junk food. Most of these posts will probably involve a pretty hefty pick of my mother's brain, and this first one is no exception.

Before you can start using your kitchen to save money, it's got to be properly equipped. So here's a list of tools you should have in a functional kitchen. I'm not saying you need to run out and buy all of this right away, but keep at least a mental note of this list for when you're at Goodwill. These items would definitely count as a purchase with utility! And now, a list I got my mom to write for me:

General Use:

- A paring knife and 8- and/or 10-inch french knives. Buy just the two or three of a good brand and you'll have them forever. Buying a whole set of a cheap brand may seem more useful, but the knives won't sharpen well, and might even bend. A few good knives are more use than any number of slicing and chopping gadgets and take up less room too. If you don't know anyone who can tell you how to use them properly, go here: http://usa.jahenckels.com

/index.php?simple_view=88 - A knife sharpener. Get one where you get the knives. Not a supermarket gadget.

- A knife block, magnetic knife holder, or drawer inserts (Target used to have plastic version.) Please don't store them loose in a drawer with other items. Please.

- 2 cutting boards, non wood can go in dishwasher, if you have one.

- A grater. You can buy grated cheese, but block cheese is cheaper. Besides, you may need to grate vegetables or fruits or other things.

- A set of measuring spoons and cups.

- A strainer and/or a colander

- A couple of mixing bowls and miscellaneous small bowls.

- A veg. peeler, bottle opener and can opener

- A couple of large spoons and spatulas wooden or high temp. resistant silicone.

- A pancake turner/burger flipper/fish slice/spatula (I've heard this tool called so many names!) Heat proof plastic is best on your non-stick skillet.

- A whisk.

Cookware:

- Non-stick skillet, thick and heavy, the best you can afford, on sale.

- 1 small and 1 large saucepan, thick bottom, can be found at middling prices.

- Large pot for boiling water, can be quite thin and cheap--but will only be good for boiling water as anything else will stick.

- 2 Heavy duty baking sheets for pizza, cookies, baking potatoes. Heavy means get professional half or quarter sized sheet pans from a professional supply store if you can. Otherwise, as heavy as you can get.

- Heavy, non-stick 9"x11" inch pan for lasagna, roasts and cakes.

- Casserole dishes. You know, Corningware ™. If you are buying this item in thrift shops, look for the brand name. Anything else you can't be sure if it is dishwasher and freezer and microwave safe, and there's usually plenty available at thrift shops.

Appliances:

in descending order of usefulness

- A stick blender, the stick part should be metal not plastic. Try to get higher wattage.

- Slow-cooker [Crockpot! -M]

- Microwave

- A regular blender.

- A food processor.

- Toaster oven/regular toaster

- Coffee making equipment: if you really like coffee, splurge a bit for an espresso machine and bean grinder. It will save you money in the long run. [I use a french press for my everyday morning coffee. I'm convinced it tastes better, and it's easier to clean. - M]

If you like baking, add a scale, and baking pans of whatever sizes

suit you.

- a 9" square, 2 8" rounds, a loaf tin, and cooling racks.

tins and a rolling pin if pies are your thing.

Dining:

- Minimum: enough plates, bowls, glasses, coffee cups, and cutlery for the number of chairs you have at the table. Useful are extra spoons and bowls. But, in general, nobody will wash dishes until every last dish is dirty, so don't oversupply yourself with plates and glasses and cups.

- The mixing bowls can double as serving bowls. Extra plates are fine for serving platters, until you come across one in a thrift shop. A couple of serving spoons with and without holes.

I was lucky, I wound up inheriting a lot of my parents' old kitchen stuff so I got a lot of these items for free. In fact, it might do you well to see if your parents want to replace any of the items on this list- then you can take the old one! Yard sales & thrift shops are almost always guaranteed to have most of these items on the cheap. But please with pots, pans, baking pans, don't buy cheap just because it's cheap. Buying a cheap cookie sheet or saucepan will just end in misery, a cooking implement that's a pain in the ass to clean. It goes without saying that you shouldn't buy cheap knives. (Though we've said it twice now!) Bigger ticket kitchen purchases are investment purchases, if you shop for them wisely they can save you hundreds of dollars in the long run.

It's Not a Bargain if You Didn't Need It!

My love for thrift shops, clearance sales, and great deals in general knows no bounds. Nearly everyone gets a kick out of getting something on sale, even if they're idiot spenders. I once got a blender for free by showing up to a Goodwill grand opening. The first 100 people in line got $10 gift cards, and the blender was $8.99. With the remaining $1.01 on the card I bought a big glass jar to store bulk-purchased rice, beans, or whathaveyou.

But that blender wasn't an impulse buy. I went to the grand opening with the intention of buying a blender. I would've bought it even if the price had been slightly over $10.

One of the biggest pitfalls for bargain shoppers is how easy it is to be blinded by a deal. If you go to Goodwill and you spend upwards of $100 on clothes or household items you didn't necessarily need, you haven't SAVED money. You've spent it. And unless that $100 went to a bigger ticket item you've been planning to purchase for a while, office attire, or another purchase that will have some serious utility- that $100 could have been much better spent. Or saved.

Thrift shops can be the most dangerous marketplace for this kind of thinking. After all, one of the best reasons to thrift shop is the treasure hunting aspect- and it can be very difficult to talk yourself out of that $50 doohickey going for $10 at Goodwill. If the price is low enough, you can convince yourself that you need anything. But after a while you've spent $10 to save $40 any number of times, but you still don't have $40! You didn't actually save $40 unless you socked $40 away in a savings account. You spent $10!

The best way I know to curb faux bargain spending is to have a specific purchase and price in mind when you go to a thrift shop or clearance sale. If you can't find an egg beater for $7.99 or new white dress heels for $5.99, don't spend any money at all. Or if you must spend money, spend it on a book, video, or other item with lasting value that generally costs very little ($.99-$2.99) secondhand. But please, if you go in planning to spend $5.99 on heels, don't spend $24.99 on an air purifier.

Tuesday, March 18, 2008

But I Only Paid $300 For This Luxury Good I Don't Need Anyway!

Note: This post is the first in a series about why young adults spend the way we do, and how to re-tool our thinking.

There are hundreds, maybe thousands, of books & blogs dedicated to personal finance, and I'm a dedicated reader of several. But while there are tons of great blogs on how to save money, how to invest, how to life-hack, how to get out of debt, and how to be a good consumer- very few blogs broach the topic of our spendthrift nature or how twentysomethings wind up in debt or if not in debt, barely scraping by paycheck to paycheck in the first place.

Most financial advice for young people is about paying off debts incurred by college expenses which, while useful for many, doesn't apply to thousands of other young folk. Everytime I crack open a book about personal finance for young adults I get about a chapter in before I realize that they're not talking to me. I don't have student loans, I don't have thousands of dollars of credit card debt, I don't have a degree that isn't helping me get the salary the career counselor promised me, and most of the post-college how-to-make-it-on-your-own advice is old news.

I do have some medical debt, a monstrously huge library fine, a utility bill I never paid off, and a charged off auto loan. But even all that adds up to less than $3000, none of which is accruing interest. And that debt exists because as I racked it up, I felt entitled to eating out most nights, buying fancy cocktails at bars, owning designer clothes, having a massive CD collection or whatever the whim of the moment was.

So why did a smart girl like me- raised by frugal parents- spend like a blithering idiot the second I moved out? I think most of us are high on freedom, whether we've escaped to apartments down the street from our parents or to dorm rooms hundreds of miles away. Whether we're living on paychecks or allowances, we're still children in many ways. Financial realities haven't quite set in yet, and most of us grew up in a culture that encourages the image of riches rather than the reality of wealth.

If we can manage to look well off, we can believe we are well off. In my case looking rich meant financing a fairly new car, buying loads of designer clothes (used, of course! I saved money!...More on that logical fallacy at a later date.), treating my friends to dinners I couldn't afford and rounds of drinks we shouldn't have been drinking anyway. Looking rich might mean different things to different folks, but the principal is the same: We end up sacrificing our needs for our wants.

Some people manage to never fall into these nasty spending habits, or are able to rely on scholarships or their parents if they do, but I think the vast majority of us spend like this at some point, even if we think we don't.

Most of my more embarrassing tales of financial idiocy revolve around buying expensive clothes. To this day I've still got a $400 purse in my closet. Granted, I bought it on sale for $320 and then got another $20 taken off because of a tiny nick on one of the handles, but I still paid (with tax) over $300 for a purse I haven't even used in over a year. My everyday purse was bought on clearance at Target for $7.98. Go figure.

What are your most embarrasing over-spending stories? What did you pay too much for and why did you do it? Post your answer in the comments. The best story gets an as yet undeclared prize. Probably from-scratch brownies or maybe my like-crack to some ginger snaps.

Next entry in this series: What makes us stop spending like idiots, and if you haven't stopped yet, reasons to change your ways.

GasBuddy.com is your Friend.

With gas prices stretching ominously towards the $4 mark, driving can be one of the the more difficult areas to cut costs, especially in California. I've got a 40 minute round trip commute to work and a 1hr 20min round trip commute to my boyfriend- so even on my most conservative gasoline behavior I've got to fill my tank at least once a week. The gas stations closest to my house and work tend to be more pricey than those further afield, but by scheduling my fill up to happen on the way to Boyfriend's house or on a day when my errands take me outside of my usual routes, I can save anywhere from 30 to 50 cents on gas.

My secret? Gas Buddy, a site where members update fuel prices. When gasoline first shot above the $3 mark, I was still paying $2.70 or $2.80 and filling up for less than $30.

Another good habit is filling your tank at the quarter tank mark. For one thing, it's gentler on your car (driving around on fumes during that last hour before hitting the pump makes your engine sad), and secondly it's a built-in savings of almost $10. If you ever have a week where every penny counts- think of it as gasoline insurance- you can use up the quarter tank when you just can't afford to fill up until your paycheck clears the bank.

Monday, March 17, 2008

Preaching by Example

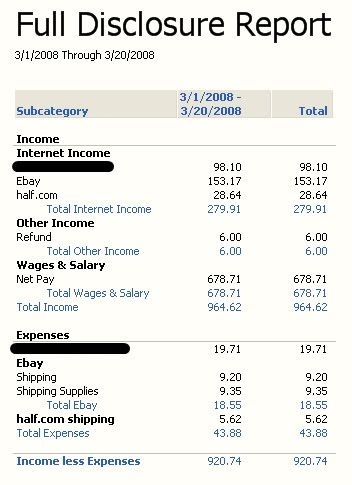

Any blogger writing on financial matters should be accountable for the advice they give. To that end, I'll be reporting my income and net worth at the end of every month in what I'll call my "Full Disclosure" post, which will be followed within a day or two by an Income vs. Expenses report. My hope is that these posts will inspire my readers to cut out a few luxury goods or learn a few DIY tricks to cut their excess spending. Below is a report of my income so far this month. The blacked out lines are income from a "surveys for cash" site I'm a member of, and I sometimes choose to sign up for free trials to get a higher payout, which is what the blacked out line in the expense category represents. I'm not disclosing the name of the site at this time as it's a referral site and I feel that posting a referral link would compromise the integrity of a fledgling blog.

This report was generated using Microsoft Money 2004.

On Clean Lungs

In the past six months I've learned to live below my means and I've quit smoking. I've been bouncing from apartment to apartment almost annually since 2002, and in September of 2007 I finally settled (I hope!) into renting a house (an actual HOUSE!) on a (man-made) lake in sunny Orange County. About the same time, I inherited my mother's copy of 'The Tightwad Gazette' - a book of hers that I'd thumbed through incessantly as a kid, fascinated with the concept that washing out ziploc bags could save money.

Of course, I promptly dumped that knowledge at 18 when I moved screaming out of my parents' house into my first apartment. I dug myself a nasty hole those first few years, the crowning achievement of which was financing a car just 2 months shy of my nineteenth birthday with an interest rate so high I'm sure the international space station astronauts could see it outside. I spent money like I didn't have to work for it and most of that was crap I've long since donated or sold for a fraction of it's original price.

Eventually my tightwad upbringing caught up to me. Little by little, concepts from Dacyzyn's books would leak their way into my everyday habits. The thought of throwing something away that might be useful? Physically painful. I slowly came to realize that for 5 years I'd been buying stuff I wanted, not stuff I needed- and that I was buying crappy versions of the things I needed so I could have fancy versions of the stuff I just wanted.

As I curbed my spending habits and began to spend more wisely, the fact that most of my peers do not do this became more and more apparent. Even those who aren't spending frivolously are not spending smart.

It is for their sake that I'm writing this blog. Some of my friends really like Frappucinos. Some of them really like designer shit. But none of them like to hear my constant refrains:

"Seriously, don't buy a frapp, you might as well burn $5 and I have a blender at home!"

"You're buying an already overpriced designer handbag new?? You might as well torch $300!!"

I quit smoking (mostly) two weeks ago and it was a lot easier than I thought it would be. The patch seems to have broken me of the physical addiction, and my desire to not spend idiotically is a strong damper for the mental addiction. Co-workers and friends keep asking me why I quit and the simplest answer is the inspiration for this blog: "Well, I might as well have been burning $5 bills."

I'll be writing about what makes us want to spend and why we feel that we must have things we don't need; how to teach ourselves to spend more intelligently, spending's effects on relationships, the differences between wants and needs plus more - all held together by practical advice including tips, recipes, links, DIY instructions, and more!